undeveloped raw land, farmland investments for sale as inflation hedge

Brazil, Argentina, Uruguay, Paraguay - news information opinion

farmland in Uruguay - sorghum fields

farmland in Uruguay - sorghum fields

By profession we are realtors for farmland / undeveloped raw land properties in Uruguay and Paraguay. This site is meant to offer news, opinion and background information on farmland investments in South America in addition to the data supplied on our main portal sites for property offers.

With money being supplied on a global scale like never before, it is ever more essential to be aware of what assets have a truly intrinsic value, what assets are and will allways be of limited supply. Farmland.

Cerro Cora 1124

CP1544 Asuncion, Paraguay

EMAIL

Paraguay mobile

0981-543158

farmland realtor

since 1997

Latin America

In the central american and andean countries fertile farmland has never been too abundant, and some of those countries also have restrictions in place regarding larger land holdings by foreigners.

Foreigners have bought large tracts of land over the last two decades, due to low valuations and absence of restrictions in

- Brazil, the inner, or “Cerrado” states like Mato Grosso do Sul, Mato Grosso, Goais, Tocantins, western Bahia

- Argentina

- Uruguay

- Paraguay

- Bolivia, the eastern lowlands

- Bolivia might be the country with the nominally cheapest land, due to low level of development and leftist populist Evo Morales government and risk of political violence and measures against large landholdings. Few investors buy there currently and it is indeed a high risk investment.

- The second lowest land valuations are found in Paraguay, and at an attrative chance/risk ratio. The most productive farms (soya, sugar cane), intensivly operated and close to posessing plants currently cost US$6000-10000 per hectare, cattle ranch land US$500-2000, virgin land, forest covered, in the semi arid Chaco region with good soil fertility costs US$150-600 per hectare.

Buyers of land in the Paraguay Chaco are Agri Investors / farmers from Brazil and Uruguay followed by domestic buyers and Western European investors.

Uruguayan cattle rancher bought 700.000 hectare in the Paraguay Chaco from 2006 until 2010 ( En 2010 se llevan vendidas más de 100.000 hectáreas a extranjeros

Paraguay has the region’s most favorable tax regime, 10% personal income tax, 10% VAT. On the down side Paraguay ranks comparably low in transparency, quality of public services, rule of law, short comings often associated with a Third World country.

- Uruguay is in many aspects the opposite case. A mature civic society with strong rule of law and a distinctive european flair.

Just it is not cheap any more. With US$8000-12000 per hectare for prime crop land (soya, corn, wheat), US$4000-6000 per hectare for good cattle pasture (which would include some minor fraction suitable for cropping) operational returns should be expected to be in the 3-4% range. Virgin land does not exist anymore in Uruguay.

Income is taxed in the 15-25% range, VAT being 22%

Uruguay country information - taxes costs regulations

- Argentina is geographically and hence agriculturally very diverse. The heartland, the humid Pampa is comparable to Uruguay, so is the price/value for farmland (though in Argentina some top fertility crop lands rank higher still in both price and productivity then anything in Uruguay, costing up to US$15000/ha).

Cropland in the tropical north, Formosa Province etc, costs around US$3000, cattle pasture land of medium productivity costs anywhere between US$1000 and 3000, best pasture lands (fattening) up to US$5000/ha

Virgin land, with potential for profitable future farming/ranching start at US$300/hectare

While argentinian income tax and VAT is within the region’s typical rates, it levies an additional tax of around 20-30% on agri exports like soya (not on the profit but on the revenue), which weighs substantially on producers.

Political issue of foreign land holdings : Estimates of share of foreign hold land in Argentina vary between 10 and 15%. A law passed parliament that limits the maximum of land a foreigner can purchase to 1000 hectare in the agricultural heartland, somewhat larger sizes in less fertile areas, and the maximum share of the nation's entire land to 15%, and to 15% of a single province, and to 15% of a single municipality. (existing land holdings are not effected)

- Brazil without intending to discuss Brazil's land market, due to its sheer size and regional variations - legal practise changed significantly in 2010, restrictions now limiting the size of farm land foreign entities can buy. Limits range from 250 hectare in densely populated intensively farmed regions like Sao Paulo to 5000 hectare in sparsely populated region like Amazonia.

Since the law also puts a limit on total share of foreign owned land for each district, some district level governments refuse any permit, due to lack of knowledge how much land is foreign owned already. Again, as in Argentina, established land holdings are not effected.

Other world regions

Other countries exist where fertile farmland is cheap. Just foreigners can not be legal landowners (Russia, Ukraine, Kazakhstan, Sasketchewan and Manitoba of Canada). In Romania and Bulgaria fertile land was rather cheap for a brief period in recent years but not so any more.

In the vast majority of asian and african countries foreigners can not own farmland (just lease it) One exception, and with low prices, would be South Africa but the race and crime issue there is to be kept in mind. Land in western industrialised nations

(including Australia and New Zealand) is too expensive to be discussed in this context.

Buyers of land have a basic decision to make

- buy farmland and operate it oneself, disadvantage – being a farmer is a profession not to be taken lightly and being the employer of local farm workers is not an easy task either, or

- buy farmland and hire a management company to run it, disadvantage – management fees may eat up significant part of profits, or

- buy farmland and rent it out, rental return typically being in the 3% range, advantage – requires less attention then any of the above, and income being rather (though not 100%) predictable, or

- buy raw land that has potential to be converted into farmland (land banking), advantage – least attention required, disadvantage – no operational return.

Land is the ultimate limited asset, more so then gold, where more of it is continously extracted from mines. The purest play of land investment would be to buy raw (virgin) land where you pay no premium for anything man-made (like buildings, like an operational farm set up).

But here the real analysis just starts. Over 90% of the world’s raw, idle lands will for ever stay that way, without comercial value, being deserts, semi deserts, montain ranges, or lands that should be left untouched due to environmental considerations.

Virgin land with potential to be productive agricultural land soon, would have a favorable combination of climate, topograhy, soil fertility, environmental viability. If one looks for recreational potential, obviously scenery counts more.

Land that is still virgin nowadays is so usually due to being remote, difficult to reach,

so the extent of remoteness would be another factor to constitute the value of raw land.

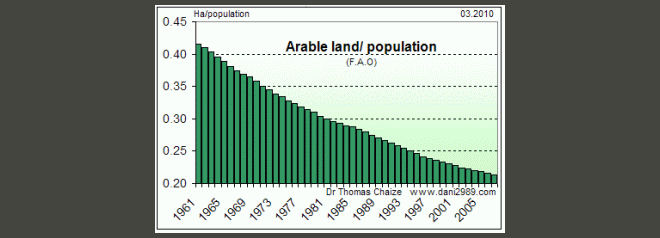

The rate of global arable land per capita halved from 0.4 to 0.2 hectare in our lifetime.

Virgin forest as carbon credit investment

A new aspect would be the holding of forest land as a REDD assetDiscussing REDD carbon credits as of January 2014 is still highly hypothetical

The global market for carbon credits (carbon offsets) is well established, liquid, with daily quotations, 1x metric ton of CO2 equivalent (tCO2e) costing US$12-20. It is however limited to projects that sequester carbon. It is being discussed to include measures of "REduction of Deforestation and Degradation" (REDD). It basically means to grant credits for simply not cutting forests.

A difficult issue will be to quantify the value of not doing something

One hectare of higher growth types of forest in the Paraguay Chaco might store 200t carbon. What might then be the anual environmental value of not cutting it ? 1/50 of that figure, equaling 4t CO2e ? Difficult to state. In such a case a forest owner might generate a gross income of US$60 or 80 per hectare per year through carbon credits. That is for an asset that currently costs US$300.

Costs for certifying and marketing would still need to be deducted to calculate net income. Also countries where lands are located might be inclined to tax such incomes substantially.

More on this topic forest investments preserving natural forests" and ECONOMIST article "money grows on trees"

horse meat

as a consumer do consider to turn to horse meat. It is delicious, tender and lean. But above all, the horse is no ruminant, it does not emit methane while digesting its food the way ruminants do.

Considering to become a cattle rancher in Argentina or Uruguay, do consider to become a meathorse rancher instead. Not that there would money to be made at current stage (2018), but methane emission is an issue mankind must address.

Further reading : horse meat

Gentleman Farmer's lifestyle and agriculture investment combined

Go to your local book store, the romantic novel section, and see how many book covers feature some grand rural estate mansion. There is something about the rural estate that conjures up nobility, destiny, the cause of centuries. It is no asset like any otherGo invest the same amount of money in an upmarket urban residence, will you have the same associations of having acquired something that will remain within your family for the next 300 years?

The Pampa of Argentina and Uruguay with its benign moderate climate has for the last 150 years been a place where landowners have built estate houses of both latin architecture with courtyards and open galleries or at times following rather a north western european manor style, their pastime being polo, horse races, hunting and at the same time often being pioneers in their field, introducing a new cattle race to the new world or a new crop variety. Their estates, the estancias measured many thousand hectares.

On and off, to this day a property, an estancia enters the market that allows for just that, a Gentleman Farmer's lifestyle and an agriculture investment combined.

one current real estate listings:

fsbo1) Uruguay - Estancia of the 1880s, 167 hectare cropland/rangeland

subscribable on

farmland offers & news feed

.

Feb.2013 : carbon offsets

The EU announces measures to reduce supply of carbon offset certificates, in that way increasing their market value and hence the incentive to reduce emissions altogether ( SPIEGEL magazine on 19.Feb.2013 Emissionshandel: EU will CO2-Zertifikate drastisch verknappen )

Feb.2013 : KFW

Germany's Kreditanstalt fuer Wiederaufbau (KFW) bank will team up with Rioforte to invest aprox €25m in farming in Paraguay

Jan.2013 : China

The issue of China's hunger of agro commodities is around since many years but still seems to be at an early stage. Speakers of this years's Hong Kong Asian Financial Forum emphasise that "China must invest abroad for food security, forum told", Hong Kongs major newspaper SCMP writes on 22.Jan.2013

Dec.2012 : $1000bn

Macquarie, the Australian Investment Bank, estimates that current institutional investment in global agriculture is just beginning, seeing potential for $1000bn in coming years, 25 times the current volume

in 05.Dec.2012 agrimoney.com article “Fund farm buying 'only just begun' - even at $40bn”

June 2012 : The next wave

A Reuters article reports

on a June 27th London agri investment summit and on US and European investment funds' increasing focus on farmland investments. with investment volume believed to double from 2011 to 2015.

TIAA-CREF alone, a US university professors pension fund, is said to have formed with partners a month ago a $2billion fund for investment in farmland

it is beautiful, too